Stocks started another week with a very strong Monday performance. Friday's shortened session, however, was long enough to more than erase the earlier gains of many stocks and ETFs.

Talk of "sovereign default" related to the Dubai World request for a debt "standstill" overcame most other news that had transpired during the course of the week. As a result, charts suddenly appear to have broken down.

Below is the chart of the S&P 500. That big red bar representing Friday's action is clearly visible and it certainly looks like a dangerous downdraft, signalling more pain ahead.

But is this really a serious break? Was Friday's volume so low just because it was an abbreviated session? Or wasn't there much conviction to the sell-off? What do the Alert HQ statistics suggest?

The view from Alert HQ --

Charts of some of the statistics we track at Alert HQ are presented below:

This first chart presents our moving average analysis. The chart shows that roughly half of the stocks and ETFs we track are still above their 50-day MA. Not shown on the chart is that less than 40% are above their 20-DMA. As shown by the magenta line, the number of stocks whose 20-DMA is above their 50-DMA is slowly dwindling but is still above 57% which is not too bad. Despite the sell-off at the end of the week, data on this chart suggests that stocks are holding their own and may not have much further to fall.

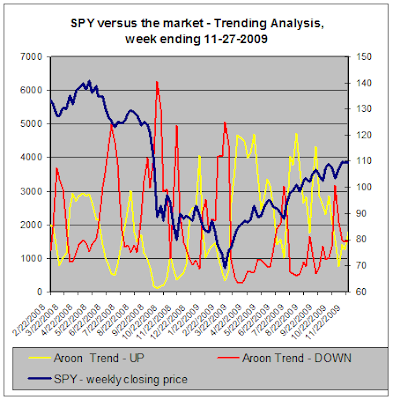

The next chart provides our trending analysis. It looks at the number of stocks in strong up-trends or down-trends based on Aroon analysis.

A notable feature of today's chart is that the number of stocks in up-trends actually increased this week despite the Dubai news and the Friday sell-off. In addition, the number of stocks in down-trends did not increase. Furthermore, the number of up-trends has just crossed above the number of down-trends. There is a good potential that we are seeing early signs of stocks gathering themselves for another run to new highs.

Conclusion --

Stocks had been going nowhere for the last two to three weeks. At first glance, Friday's action appears to have resolved the indecision - the new direction is now to the downside. Or is it?

Our statistics as displayed in the charts above show that stocks are still somewhat firm. The Dubai sell-off did some damage but, to truly push markets lower, we will need another catalyst. With earnings season over, we can look to economics reports to drive the markets.

Certainly, there will be plenty of data for investors to munch on. This week will bring November Construction Spending, the ISM Index, Pending Home Sales, Auto Sales, Truck Sales, ADP Employment Report, Crude Oil Inventories, the Fed Beige Book, Initial Jobless Claims, Continuing Claims, Q3 Productivity and Labor Costs, the Employment Cost Index, ISM Services Index, Nonfarm Payrolls, the Unemployment Rate, Average Workweek, Hourly Earnings and Factory Orders.

Given that the economy is improving but is not yet out of the woods, a slate of reports this large is bound to cause some volatility. This means we could indeed see more downside. But if the charts above are showing the underlying strength that I think they are, then, barring a huge disappointment in the Nonfarm Payrolls report, stocks might actually start to rebound by the end of the week.

So have the charts broken down? Yes, but not seriously. Keep in mind, the primary trend remains UP.

Talk of "sovereign default" related to the Dubai World request for a debt "standstill" overcame most other news that had transpired during the course of the week. As a result, charts suddenly appear to have broken down.

Below is the chart of the S&P 500. That big red bar representing Friday's action is clearly visible and it certainly looks like a dangerous downdraft, signalling more pain ahead.

But is this really a serious break? Was Friday's volume so low just because it was an abbreviated session? Or wasn't there much conviction to the sell-off? What do the Alert HQ statistics suggest?

The view from Alert HQ --

Charts of some of the statistics we track at Alert HQ are presented below:

This first chart presents our moving average analysis. The chart shows that roughly half of the stocks and ETFs we track are still above their 50-day MA. Not shown on the chart is that less than 40% are above their 20-DMA. As shown by the magenta line, the number of stocks whose 20-DMA is above their 50-DMA is slowly dwindling but is still above 57% which is not too bad. Despite the sell-off at the end of the week, data on this chart suggests that stocks are holding their own and may not have much further to fall.

The next chart provides our trending analysis. It looks at the number of stocks in strong up-trends or down-trends based on Aroon analysis.

A notable feature of today's chart is that the number of stocks in up-trends actually increased this week despite the Dubai news and the Friday sell-off. In addition, the number of stocks in down-trends did not increase. Furthermore, the number of up-trends has just crossed above the number of down-trends. There is a good potential that we are seeing early signs of stocks gathering themselves for another run to new highs.

Conclusion --

Stocks had been going nowhere for the last two to three weeks. At first glance, Friday's action appears to have resolved the indecision - the new direction is now to the downside. Or is it?

Our statistics as displayed in the charts above show that stocks are still somewhat firm. The Dubai sell-off did some damage but, to truly push markets lower, we will need another catalyst. With earnings season over, we can look to economics reports to drive the markets.

Certainly, there will be plenty of data for investors to munch on. This week will bring November Construction Spending, the ISM Index, Pending Home Sales, Auto Sales, Truck Sales, ADP Employment Report, Crude Oil Inventories, the Fed Beige Book, Initial Jobless Claims, Continuing Claims, Q3 Productivity and Labor Costs, the Employment Cost Index, ISM Services Index, Nonfarm Payrolls, the Unemployment Rate, Average Workweek, Hourly Earnings and Factory Orders.

Given that the economy is improving but is not yet out of the woods, a slate of reports this large is bound to cause some volatility. This means we could indeed see more downside. But if the charts above are showing the underlying strength that I think they are, then, barring a huge disappointment in the Nonfarm Payrolls report, stocks might actually start to rebound by the end of the week.

So have the charts broken down? Yes, but not seriously. Keep in mind, the primary trend remains UP.

Comments

Post a Comment