In the face of a week full of government actions and lousy economic reports the markets responded by dropping like a rock. Major averages finished the week down between 4% and 5%. The S&P 500 finally closed below its November low, just as the Dow did a week ago. This is not a good thing, especially since the NASDAQ and the Russell 2000 are getting close to their lows, as well.

Again, the government was at the center of a number of market-moving news items. The Treasury took a larger stake in Citi by converting preferred stock to common stock and providing Citi a boost in its measure of tangible common equity. Bank stress tests were announced and apparently 19 of the biggest banks will be evaluated over the next couple of months. The new administration's budget plan was revealed and health care companies, especially those in the managed care sector, plunged in response. The budget also suggested college students should borrow directly from the government so student loan lenders and some of the for-profit schools tanked. On Tuesday, Ben Bernanke delivered his semi-annual briefing to Congress and his tone was up-beat enough to allow the market to rebound from Monday's big loss.

There were a number of high profile dividend reductions from the likes of General Electric and JPMorgan-Chase and it is adding to the sense that too many companies are cutting dividends lately.

Then there were economic reports that only served to put further pressure on stocks: 4Q2008 GDP at -6.2% was down more than anyone expected. All kinds of housing data was down more than expected: house prices, existing home sales, new home sales all hitting multi-decade lows. The Durable Goods report for January was down more than expected and December was revised significantly downward. The picture this painted of manufacturing contributed to the 8% slide in the industrial sector this week.

The negativity in market action took its toll on our TradeRadar statistics and our charts are not particulary encouraging. Read on for the gory details...

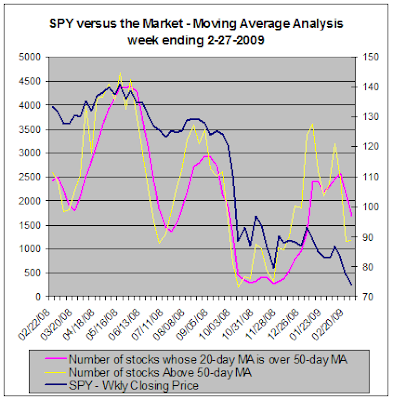

This first chart presents the moving average analysis for the entire market and contrasts it with the performance of the S&P 500 SPDR (SPY). When the number of stocks trading above their 50-day moving average (the yellow line) crosses the line that tracks the number of stocks whose 20-day moving average is above their 50-day moving average (the magenta line) there is an expectation that you will get a change in the trend of the S&P 500.

It is a surprise to see the slight up-tick in the number of stocks above their 20-day MA. This slight positive is undone by the more significant decrease in the number of stocks trading above their 50-day MA. Note also that the yellow line is continuing well below the magenta line. Implication: bearish

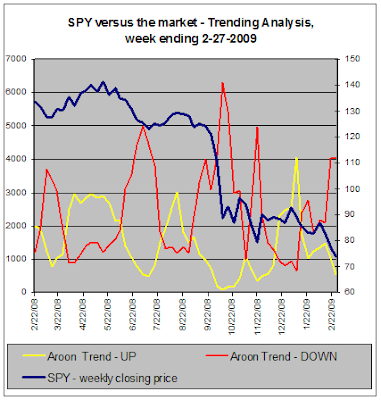

This next chart is based on Aroon Analysis and compares our trending statistics to the performance of SPY. We use Aroon to measure whether stocks are in strong up-trends or down-trends. The number of stocks in down-trends is indicated by the red line and the number of stocks in up-trends is indicated by the yellow line.

In this chart, the deterioration cuts both ways: the number of stocks in up-trends has decreased this week while the number of stocks in down-trends has increased. The numbers are bad but haven't reached extremes we saw back in September and November. Could things get worse? It's certainly possible. Implication: bearish

Economic reports this week seemed to intensify the gloom in markets. Instead of bad news being shrugged off, bad news was taken at face value and stocks suffered. Sentiment now seems weak and investors almost seem shell-shocked and resigned to falling markets. And why not? There are at least as many indications things are getting worse as there are indications that things are stabilizing. And this seems to be a world-wide phenomena.

Providing more opportunities for gloom and doom, we will receive a ton of economic reports this week, among them: personal income, personal spending, core PCE, construction spending, ISM Manufacturing Index, auto sales, truck sales, ADP employment change, ISM Services Index, productivity, unit labor costs, initial jobless claims, factory orders, the dreaded Non-Farm Payrolls report, the unemployment rate and consumer credit. In addition, on Wednesday, we get the Fed Beige Book.

So, with negative sentiment and sagging technicals, markets are staggering out of February. Of course, when it seems things are just totally awful, that's when the rallies occur. What do you think? Can stocks dig themselves out of this hole? Let's hope this new month will be better than the one that just ended.

Again, the government was at the center of a number of market-moving news items. The Treasury took a larger stake in Citi by converting preferred stock to common stock and providing Citi a boost in its measure of tangible common equity. Bank stress tests were announced and apparently 19 of the biggest banks will be evaluated over the next couple of months. The new administration's budget plan was revealed and health care companies, especially those in the managed care sector, plunged in response. The budget also suggested college students should borrow directly from the government so student loan lenders and some of the for-profit schools tanked. On Tuesday, Ben Bernanke delivered his semi-annual briefing to Congress and his tone was up-beat enough to allow the market to rebound from Monday's big loss.

There were a number of high profile dividend reductions from the likes of General Electric and JPMorgan-Chase and it is adding to the sense that too many companies are cutting dividends lately.

Then there were economic reports that only served to put further pressure on stocks: 4Q2008 GDP at -6.2% was down more than anyone expected. All kinds of housing data was down more than expected: house prices, existing home sales, new home sales all hitting multi-decade lows. The Durable Goods report for January was down more than expected and December was revised significantly downward. The picture this painted of manufacturing contributed to the 8% slide in the industrial sector this week.

The negativity in market action took its toll on our TradeRadar statistics and our charts are not particulary encouraging. Read on for the gory details...

TradeRadar Alert HQ Stock Market Statistics --

Each week our Alert HQ process scans over 7400 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following charts are based on daily data and present the state of some of our technical indicators.This first chart presents the moving average analysis for the entire market and contrasts it with the performance of the S&P 500 SPDR (SPY). When the number of stocks trading above their 50-day moving average (the yellow line) crosses the line that tracks the number of stocks whose 20-day moving average is above their 50-day moving average (the magenta line) there is an expectation that you will get a change in the trend of the S&P 500.

It is a surprise to see the slight up-tick in the number of stocks above their 20-day MA. This slight positive is undone by the more significant decrease in the number of stocks trading above their 50-day MA. Note also that the yellow line is continuing well below the magenta line. Implication: bearish

This next chart is based on Aroon Analysis and compares our trending statistics to the performance of SPY. We use Aroon to measure whether stocks are in strong up-trends or down-trends. The number of stocks in down-trends is indicated by the red line and the number of stocks in up-trends is indicated by the yellow line.

In this chart, the deterioration cuts both ways: the number of stocks in up-trends has decreased this week while the number of stocks in down-trends has increased. The numbers are bad but haven't reached extremes we saw back in September and November. Could things get worse? It's certainly possible. Implication: bearish

Conclusion --

From a technical analysis point of view, stocks have been acting very shaky. It's hard to believe how the averages have moved relentlessly downward. Each day it seems a bounce is due but it never quite happens. The Dow and the S&P 500 are both hitting new lows yet the NASDAQ and the Russell 2000 are still roughly 9% and 7% above their November intra-day lows, respectively. That's good, right? The worrisome factor is that both the NASDAQ and the Russell 2000 have broken down below their upward trend lines just like the Dow and the S&P 500 have. So all four averages appear to be establishing new down-trends and the lows from late January, previously acting as support, will now be resistance.Economic reports this week seemed to intensify the gloom in markets. Instead of bad news being shrugged off, bad news was taken at face value and stocks suffered. Sentiment now seems weak and investors almost seem shell-shocked and resigned to falling markets. And why not? There are at least as many indications things are getting worse as there are indications that things are stabilizing. And this seems to be a world-wide phenomena.

Providing more opportunities for gloom and doom, we will receive a ton of economic reports this week, among them: personal income, personal spending, core PCE, construction spending, ISM Manufacturing Index, auto sales, truck sales, ADP employment change, ISM Services Index, productivity, unit labor costs, initial jobless claims, factory orders, the dreaded Non-Farm Payrolls report, the unemployment rate and consumer credit. In addition, on Wednesday, we get the Fed Beige Book.

So, with negative sentiment and sagging technicals, markets are staggering out of February. Of course, when it seems things are just totally awful, that's when the rallies occur. What do you think? Can stocks dig themselves out of this hole? Let's hope this new month will be better than the one that just ended.

Comments

Post a Comment