This blog generally focuses on analysis of tech stocks, ProShares ETFs and economic reports. So why am I talking about gold today?

This blog generally focuses on analysis of tech stocks, ProShares ETFs and economic reports. So why am I talking about gold today?This weekend's Alert HQ process generated the usual list of Bollinger Band Breakouts. These are stocks and ETFs that have exceeded exceeded either their upper Bollinger Band or their lower Bollinger Band.

What is so unusual this time is the large number of companies related to gold or silver mining that showed up on the list as Bullish Breakouts. In other words, all of these guys have popped up above that upper Bollinger Band.

The following list shows all those gold or silver-related stocks, 27 in all, as extracted from the total list of 103 breakouts:

| Symbol | Name |

|---|---|

| ABX | BARRICK GOLD CORP. |

| AEM | AGNICO-EAGLE MINES LTD. |

| AGQ | PROSHARES ULTRA SILVER |

| ANV | ALLIED NEVADA GOLD CORP. |

| AXU | ALEXCO RESOURCE CORP. |

| BVN | COMPANIA DE MINAS BUENAV. |

| EXK | ENDEAVOUR SILVER CORP. |

| GDX | MARKET VECTORS GOLD MINERS ETF |

| GRS | GAMMON GOLD INC. |

| GRZ | GOLD RESERVE INC. CL A |

| GSS | GOLDEN STAR RESOURCES LTD. |

| HMY | HARMONY GOLD MINING COMPANY LIMITED |

| JAG | JAGUAR MINING, INC. |

| KBX | KIMBER RESOURCES, INC. |

| MGN | MINES MANAGEMENT, INC. |

| MMG | METALLINE MINING CO |

| NEM | NEWMONT MINING CORP. |

| NXG | NORTHGATE MINERALS CORPORATION |

| PLM | POLYMET MINING CORP. |

| PMU | PACIFIC RIM MINING CORPORATION |

| SLW | SILVER WHEATON CORP |

| SVM | SILVERCORP METALS, INC. |

| THM | INTERNATIONAL TOWER HILL MINES, LTD. (CANADA) |

| UXG | U S GOLD CORP |

| VGZ | VISTA GOLD CORP. NEW |

| GOLD | Randgold Resources Limited |

| SSRI | Silver Standard Resources, Inc |

I will be the first to admit that I am not an expert on gold nor am I a gold bug. Having dabbled in a gold ETF once I barely got out without a loss. What is intriguing to me, however, is the fact that so many of these companies and ETFs have surged ahead in unison.

The last time I saw something like that happen, the sector in question made a strong move upward. Back in mid-July, our list of Swing Trading Signals showed a big contingent of commodity ETFs with BUY signals. Many of them subsequently ran up 10% to 15% in the span of about two weeks. Not bad for a trading gain.

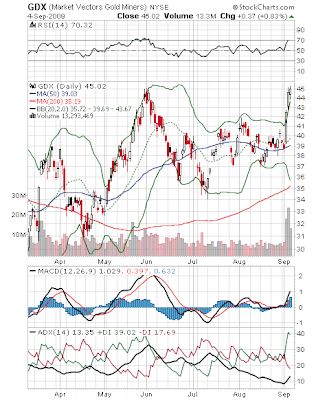

With gold and silver stocks and ETFs suddenly showing higher than average volatility and breaking sharply to the upside on higher volume, I am wondering if this time the surge will stick. The following chart shows GDX, one of the ETFs listed above. This is as good a proxy as any for the entire sector.

You can see that moving averages, MACD and DMI are all moving in bullish directions. The question is, is there enough strength to get beyond the old high at $45 that was established back in early June?

RSI and William's %R all indicate that GDX is now over-bought. But the momentum is undeniable. Making a new high this week would go a long way toward vindicating the gold bugs.

Over at Market Club, they have a free video that gets into the technical aspects even deeper than I have. You'll need to see this video if you want to know why they think gold is poised to go even higher.

Disclosure: none

Comments

Post a Comment