I enjoy reading the monthly Merrill Lynch Research Investment Committee report, known as the RIC Report. There is always some concept that is new to me and sheds some light on current market conditions.

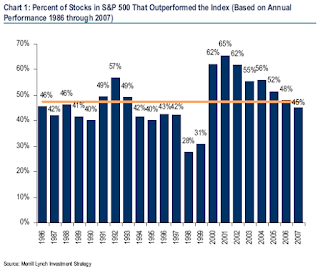

February's report had an interesting chart detailing the percentage of stocks that outperformed the S&P 500 index in a given calendar year.

Merrill contends we are currently experiencing a serious slowdown in global corporate profit growth. Merrill further contends that "historically, leadership in the financial markets tends to narrow (i.e., fewer and fewer investments tend to outperform) when the profits cycle decelerates because growth becomes a scarce resource".

As can be seen in the chart, prior to the Internet bubble, the percentage of companies outperforming the S&P 500 stayed within a modest range under 50%.

In the 1998-1999 timeframe, with the tech bubble in full swing, fewer and fewer stocks outperformed the S&P 500 despite profit acceleration.

Post-Internet bubble, we see a significant jump in the number of stocks outperforming the index. This indicates a broader participation in profit growth. Merrill indicates this is the longest period of broad market outperformance in the the history of their data. In terms of absolute numbers this did continue for a number of years but, on average, it has been declining steadily since the peak in 2001. In 2006 and 2007, we see that percentage has now dropped below 50%.

So where does that leave us?

Declining leadership, Merrill feels, is an indicator of slowing profit growth. When leadership falls below the long-term average, as it has today, investors should beware.

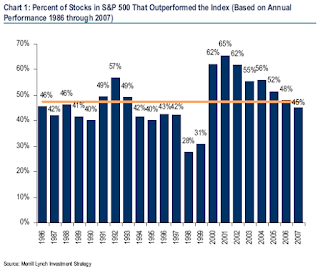

February's report had an interesting chart detailing the percentage of stocks that outperformed the S&P 500 index in a given calendar year.

Merrill contends we are currently experiencing a serious slowdown in global corporate profit growth. Merrill further contends that "historically, leadership in the financial markets tends to narrow (i.e., fewer and fewer investments tend to outperform) when the profits cycle decelerates because growth becomes a scarce resource".

As can be seen in the chart, prior to the Internet bubble, the percentage of companies outperforming the S&P 500 stayed within a modest range under 50%.

In the 1998-1999 timeframe, with the tech bubble in full swing, fewer and fewer stocks outperformed the S&P 500 despite profit acceleration.

Post-Internet bubble, we see a significant jump in the number of stocks outperforming the index. This indicates a broader participation in profit growth. Merrill indicates this is the longest period of broad market outperformance in the the history of their data. In terms of absolute numbers this did continue for a number of years but, on average, it has been declining steadily since the peak in 2001. In 2006 and 2007, we see that percentage has now dropped below 50%.

So where does that leave us?

Declining leadership, Merrill feels, is an indicator of slowing profit growth. When leadership falls below the long-term average, as it has today, investors should beware.

Comments

Post a Comment