Stocks seem to have continued their winning ways these week. Or did they?

Stocks seem to have continued their winning ways these week. Or did they?Major averages turned in varied results. The Russell 2000 barely managed a 0.2% gain while, on the other end, the S&P 500 gained 1.5%. The first couple of days of the week stocks meandered. Wednesday saw a big jump. Thursday saw some consolidation and Friday was a definite down day.

Earnings reports were decent but investor reactions were mixed. The market applauded Google and JP Morgan Chase but gave Goldman Sachs, Citi and Bank of America the raspberry.

Economic reports were also decent with retail sales beating expectations, initial jobless claims less than expectations and the Empire State Manufacturing Index coming in at a level almost twice the consensus.

Where do we go from here? We'll look at some of the charts that follow and see if we can figure that out.

The view from Alert HQ --

Charts of some of the statistics we track at Alert HQ are presented below:

This first chart tracks our moving average analysis. What jumps out at me here is that SPY, the SPDR S&P 500 ETF, is moving to new highs while the number of stocks above their 50-DMA (the yellow line) has not. A further worrisome factor is that the number of stocks above their 50-DMA has failed to cross above the number of stocks whose 20-DMA is above the 50-DMA.

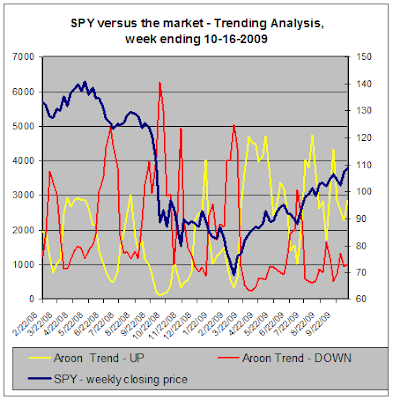

The next chart provides our trending analysis. It looks at the number of stocks in strong up-trends or down-trends based on Aroon analysis.

Here we see a similar pattern. While SPY hits new highs, the number of stocks in strong up-trends just can't seem to get going. Fortunately, the number of stocks in strong down-trends is also knocking around at a reasonably low level.

Conclusion --

It's all about the divergence this week. Major averages hit new highs this week but our statistics tell us that we are starting to see fewer stocks participating. This is seldom a recipe for a strong run to new sustainable highs.

This leaves investors dependent on some kind of strong catalyst that could turn things around. With tons of earnings on tap, good results from a few bellwethers might do the trick. Economic reports this week don't seem sufficiently important to offset the parade of earnings.

So hope for the best as those earnings reports come through. We'll need them to turn divergence into convergence.

Comments

Post a Comment