The Durable Goods advanced report for September 2011 was released on Wednesday.

I like to dig into the Durable Goods report because it can be useful for seeing how tech in aggregate is performing and how the sector may perform in the future. I always focus on two particular measures: shipments and new orders. Let's see how it played out last month.

Shipments --

I generally give less importance to Shipments since this is a backward looking measure reflecting orders that have been confirmed, manufactured and shipped. It's similar to earnings reports -- it's good to know but the data is in the past and we're more interested in the future. The following chart shows how September shipments looked for the overall tech sector:

Results for the overall tech sector were a bit weak but take a look at the next chart which tracks the Computers and related products segment:

Results here were actually quite good and, to make things even better, the previous month was revised upward.

New Orders --

This is the category that gets the most attention as it provides a glimpse of what might unfold in the future. Looking at the sector summary we see some small improvement in new orders.

The moving average is still heading down but both August and September are showing slow but steady improvement. This is a hopeful sign.

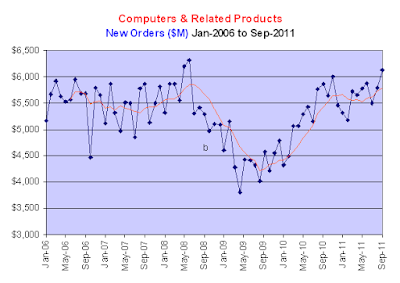

The next chart shows the Computers and related products segment:

Here again the results are very good. Indeed, this is 6% improvement over the previous month.

Conclusion --

It's no wonder Intel recently reported good earnings and forecast further growth. The Computers and related products segment has been doing quite well and, if you trust trust the new orders numbers, the segment looks like it will continue to do well. This also helps explain why tech held up so much better than other sectors during the recent downturn.

Unfortunately, it is hard to find an ETF that focuses precisely on this segment. They either have a broad combination of companies from across the tech spectrum (XLK or IWY, for example) or they concentrate on a segment like networking like IGN, for example, which seems to be struggling in comparison to the broad-based ETFs or even when compared to Cisco Systems.

The best advice then is to put on your stock picker hat and start sifting through the tech sector using a good stock screener such as the ones at TradingStockAlerts.com that allow you to screen for both bullish trends and solid fundamentals within sectors and/or industries.

Disclosure: no positions in any stocks or ETFs mentioned in this article

I like to dig into the Durable Goods report because it can be useful for seeing how tech in aggregate is performing and how the sector may perform in the future. I always focus on two particular measures: shipments and new orders. Let's see how it played out last month.

Shipments --

I generally give less importance to Shipments since this is a backward looking measure reflecting orders that have been confirmed, manufactured and shipped. It's similar to earnings reports -- it's good to know but the data is in the past and we're more interested in the future. The following chart shows how September shipments looked for the overall tech sector:

Results here were actually quite good and, to make things even better, the previous month was revised upward.

New Orders --

This is the category that gets the most attention as it provides a glimpse of what might unfold in the future. Looking at the sector summary we see some small improvement in new orders.

The moving average is still heading down but both August and September are showing slow but steady improvement. This is a hopeful sign.

The next chart shows the Computers and related products segment:

Here again the results are very good. Indeed, this is 6% improvement over the previous month.

Conclusion --

It's no wonder Intel recently reported good earnings and forecast further growth. The Computers and related products segment has been doing quite well and, if you trust trust the new orders numbers, the segment looks like it will continue to do well. This also helps explain why tech held up so much better than other sectors during the recent downturn.

Unfortunately, it is hard to find an ETF that focuses precisely on this segment. They either have a broad combination of companies from across the tech spectrum (XLK or IWY, for example) or they concentrate on a segment like networking like IGN, for example, which seems to be struggling in comparison to the broad-based ETFs or even when compared to Cisco Systems.

The best advice then is to put on your stock picker hat and start sifting through the tech sector using a good stock screener such as the ones at TradingStockAlerts.com that allow you to screen for both bullish trends and solid fundamentals within sectors and/or industries.

Disclosure: no positions in any stocks or ETFs mentioned in this article

Comments

Post a Comment