For those who are still searching for "green shoots", there is some good news from the semiconductor sector today.

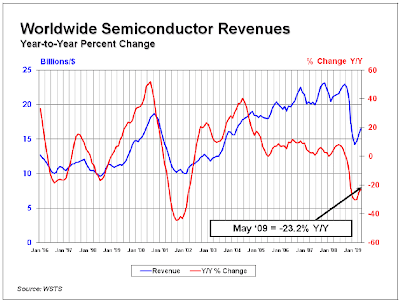

The Semiconductor Industry Association (SIA) announced today that May semiconductor revenues worldwide were up 5.4% over April. That's the good news. The bad news is that revenues are still down over 23% on a year-over-year basis.

The chart from SIA covering 1996 to the present follows:

As SIA President George Scalise commented, "The May sales numbers reflect the third-consecutive month of sequential growth for the semiconductor industry." He added that "The sequential monthly increases lead us to be cautiously optimistic about a return to normal seasonal patterns for the industry going forward."

Looking closer to home, sales in the Americas have also been up three months in a row. The chart below shows an over 5% gain from February to March with April growth slowing down and May showing another decent pick-up.

An important component of tech sector growth --

Since many observers consider semiconductor sales to be somewhat of a leading indicator for the overall tech sector, it is a welcome sign to see some consistent growth. A return to "normal seasonal patterns" implies even better growth in the months ahead.

After the stinky employment numbers reported on Thursday, any good news we can find is certainly appreciated. Let's hope those "green shoots" in the semiconductor sector continue to sprout.

The Semiconductor Industry Association (SIA) announced today that May semiconductor revenues worldwide were up 5.4% over April. That's the good news. The bad news is that revenues are still down over 23% on a year-over-year basis.

The chart from SIA covering 1996 to the present follows:

As SIA President George Scalise commented, "The May sales numbers reflect the third-consecutive month of sequential growth for the semiconductor industry." He added that "The sequential monthly increases lead us to be cautiously optimistic about a return to normal seasonal patterns for the industry going forward."

Looking closer to home, sales in the Americas have also been up three months in a row. The chart below shows an over 5% gain from February to March with April growth slowing down and May showing another decent pick-up.

An important component of tech sector growth --

Since many observers consider semiconductor sales to be somewhat of a leading indicator for the overall tech sector, it is a welcome sign to see some consistent growth. A return to "normal seasonal patterns" implies even better growth in the months ahead.

After the stinky employment numbers reported on Thursday, any good news we can find is certainly appreciated. Let's hope those "green shoots" in the semiconductor sector continue to sprout.

Comments

Post a Comment