The first week of earnings season didn't spook the market too badly and major averages managed modest gains. This makes it six straight weeks without a loss. We survived reports from Goldman Sachs, JP Morgan Chase, GE, Citigroup, Intel and Google. If you dig into the numbers of each of these bellwethers there were certainly a few questionable items; nevertheless, the fact that they were all "less bad" than expected gave investors the go ahead to push this rally for another week.

Economic reports had little effect this week. CPI and PPI came in below expectations and some bloggers resumed discussion of deflation. The markets, however, shrugged off the news. The worst report was from the housing market where starts dropped to a 510,000 annual rate, well below the expected 540,000 and a clear signal that the real estate market has not yet turned the corner.

As usual, I want to present our usual two charts to demonstrate the state of the overall stock market.

TradeRadar Alert HQ Stock Market Statistics --

Each week our Alert HQ process scans almost 7300 stocks and ETFs and records their technical characteristics. The following charts are based on daily data and presents the state of some of our technical indicators.

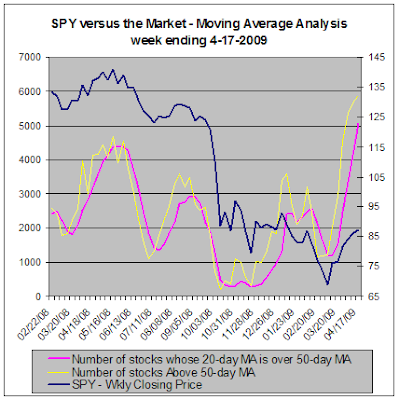

This first chart presents the moving average analysis for the entire market and contrasts it with the performance of the S&P 500 SPDR (SPY). When the number of stocks trading above their 50-day moving average (the yellow line) crosses the line that tracks the number of stocks whose 20-day moving average is above their 50-day moving average (the magenta line) there is an expectation that you will get a change in the trend of the S&P 500.

The chart shows continued advancement toward the extremes. The number of stocks trading over their 50-day MA is still increasing (though a bit more slowly) but the number of stocks whose 20-day MA has done a bullish cross over above their 50-day MA has continued to climb rapidly and has hit he highest level since we started tracking these indicators.

This next chart is based on Aroon Analysis and compares our trending statistics to the performance of SPY. We use Aroon to measure whether stocks are in strong up-trends or down-trends. The number of stocks in down-trends is indicated by the red line and the number of stocks in up-trends is indicated by the yellow line.

Here we see the faint stirrings of a moderation in the strength of this rally. The number of stocks in up-trends declined slightly and the number of stocks in down-trends increase ever so slightly.

Earnings season will reveal which stocks are weathering the economic storm. It seems recent buying has been driven by knee jerk momentum investing and investors have been indifferent to the fundamentals.

With the market up 25% from its lows and optimism rampant, it could be that it's time for fundamentals to make a comeback. That will be good for some stocks and bad for others. In other words, perhaps the markets will have less of the flavor of a casino and will return to providing a discounting and price discovery mechanism.

We can only hope.

Economic reports had little effect this week. CPI and PPI came in below expectations and some bloggers resumed discussion of deflation. The markets, however, shrugged off the news. The worst report was from the housing market where starts dropped to a 510,000 annual rate, well below the expected 540,000 and a clear signal that the real estate market has not yet turned the corner.

As usual, I want to present our usual two charts to demonstrate the state of the overall stock market.

TradeRadar Alert HQ Stock Market Statistics --

Each week our Alert HQ process scans almost 7300 stocks and ETFs and records their technical characteristics. The following charts are based on daily data and presents the state of some of our technical indicators.This first chart presents the moving average analysis for the entire market and contrasts it with the performance of the S&P 500 SPDR (SPY). When the number of stocks trading above their 50-day moving average (the yellow line) crosses the line that tracks the number of stocks whose 20-day moving average is above their 50-day moving average (the magenta line) there is an expectation that you will get a change in the trend of the S&P 500.

The chart shows continued advancement toward the extremes. The number of stocks trading over their 50-day MA is still increasing (though a bit more slowly) but the number of stocks whose 20-day MA has done a bullish cross over above their 50-day MA has continued to climb rapidly and has hit he highest level since we started tracking these indicators.

This next chart is based on Aroon Analysis and compares our trending statistics to the performance of SPY. We use Aroon to measure whether stocks are in strong up-trends or down-trends. The number of stocks in down-trends is indicated by the red line and the number of stocks in up-trends is indicated by the yellow line.

Here we see the faint stirrings of a moderation in the strength of this rally. The number of stocks in up-trends declined slightly and the number of stocks in down-trends increase ever so slightly.

Conclusion --

After six straight weeks of gains, it should come as no surprise that our indicators are beginning to show the rally slowing down, even if the slowing trend is very modest. If, as some analysts have suggested, the early March lows reflected an over-done bout of selling, it is possible that the current rally is correcting the imbalances of March. As stocks find their equilibrium point, it is possible that we will see our indicators weaken even while major averages retain much of their recent gains.Earnings season will reveal which stocks are weathering the economic storm. It seems recent buying has been driven by knee jerk momentum investing and investors have been indifferent to the fundamentals.

With the market up 25% from its lows and optimism rampant, it could be that it's time for fundamentals to make a comeback. That will be good for some stocks and bad for others. In other words, perhaps the markets will have less of the flavor of a casino and will return to providing a discounting and price discovery mechanism.

We can only hope.

Comments

Post a Comment