Alright, let's just get the bad news out of the way.

The week started with a thud as AIG reported the biggest quarterly loss ever, over $60B. Not to be outdone, HSBC reported a big drop in profits and announced it is shrinking its U.S. operations, adding another 6100 people to the unemployment rolls. Then U.S. Bancorp and Wells Fargo announced big divident cuts. You get the idea: financials under pressure yet again. The one day when the market did rally this week, the financial sector still lost ground.

Economic reports provided no relief. February job losses came in at 650,000 which was inline. It is a sad comment that an atrocious number like that is considered less than shocking. To add insult to injury, the unemployment rate jumped from 7.6% to 8.1%. This was definitely worse than expectations. The Fed Beige Book painted a consistent picture of economic weakness. January pending home sales dropped 7.7%, which was twice as bad as the expected decline of 3.5%. In the meantime, mortgage delinquencies continued their inexorable climb.

In company specific news, retail sales were awful for almost everyone except Wal-Mart. Auto sales were similarly terrible, further feeding fears of a GM bankruptcy filing.

Now for the good news. Oh, there wasn't any. Sigh...

It goes without saying that this market action is killing our TradeRadar statistics. Our charts are getting pretty close to the point where they can't get much worse. Read on for the details...

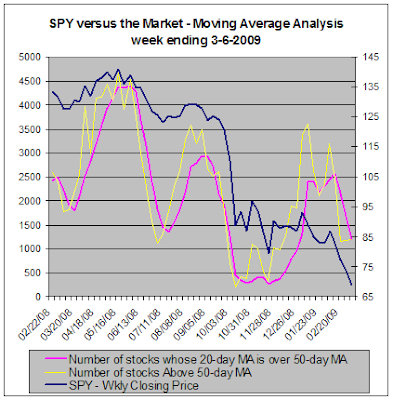

This first chart presents the moving average analysis for the entire market and contrasts it with the performance of the S&P 500 SPDR (SPY). When the number of stocks trading above their 50-day moving average (the yellow line) crosses the line that tracks the number of stocks whose 20-day moving average is above their 50-day moving average (the magenta line) there is an expectation that you will get a change in the trend of the S&P 500.

First, note that I had to expand the scale on the right to accommodate the drop in the price of SPY - not a good sign. The number of stocks whose 20-day MA is above their 50-day MA has dropped precipitously. Proving that the market is anything but logical, the number of stocks above their 20-day MA dropped well below one thousand while, as the chart shows, the number of stocks above their 50-day MA actually increased very slightly for the second week in a row. This implies that stocks will have a lot of work to do to get this chart looking bullish again.

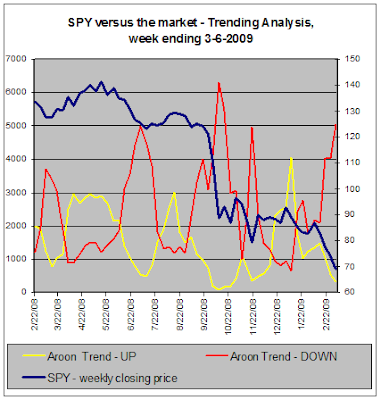

This next chart is based on Aroon Analysis and compares our trending statistics to the performance of SPY. We use Aroon to measure whether stocks are in strong up-trends or down-trends. The number of stocks in down-trends is indicated by the red line and the number of stocks in up-trends is indicated by the yellow line.

As can be seen, we are reaching extremes on this chart, too. The number of stocks in up-trends is getting perilously close to zero while the number of stocks in down-trends has exceeded all other readings except for the peak registered last October.

There are only two themes that provide hope for the markets lately. The first is the "stocks are cheap" thesis. The other is government support. We await the benefits of the stimulus package, the TALF, the TARP, the further bailouts of Citi, AIG and BofA and so on. Ben Bernanke stated the Fed will do whatever it can. The bank stress tests are underway. At some point, investors are looking for all this to start turning the economy around. But when?

This coming week, there is a modest roster of economic reports: wholesale inventories, crude oil inventories, retail sales, business inventories, weekly jobless claims and Michigan sentiment.

What is most anticipated is the discussion in Congress this week of the mark-to-market rule. If the government can't save the banks by pumping money in, the hope is that banks will be given the opportunity to ignore the losses on their illiquid securities.

I can't help but think that we are way overdue for a bounce but, as I write this, I see that the Nikkei has now gone negative after an initial run-up. Is there another week of grinding losses coming up?

The week started with a thud as AIG reported the biggest quarterly loss ever, over $60B. Not to be outdone, HSBC reported a big drop in profits and announced it is shrinking its U.S. operations, adding another 6100 people to the unemployment rolls. Then U.S. Bancorp and Wells Fargo announced big divident cuts. You get the idea: financials under pressure yet again. The one day when the market did rally this week, the financial sector still lost ground.

Economic reports provided no relief. February job losses came in at 650,000 which was inline. It is a sad comment that an atrocious number like that is considered less than shocking. To add insult to injury, the unemployment rate jumped from 7.6% to 8.1%. This was definitely worse than expectations. The Fed Beige Book painted a consistent picture of economic weakness. January pending home sales dropped 7.7%, which was twice as bad as the expected decline of 3.5%. In the meantime, mortgage delinquencies continued their inexorable climb.

In company specific news, retail sales were awful for almost everyone except Wal-Mart. Auto sales were similarly terrible, further feeding fears of a GM bankruptcy filing.

Now for the good news. Oh, there wasn't any. Sigh...

It goes without saying that this market action is killing our TradeRadar statistics. Our charts are getting pretty close to the point where they can't get much worse. Read on for the details...

TradeRadar Alert HQ Stock Market Statistics --

Each week our Alert HQ process scans over 7400 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following charts are based on daily data and present the state of some of our technical indicators.This first chart presents the moving average analysis for the entire market and contrasts it with the performance of the S&P 500 SPDR (SPY). When the number of stocks trading above their 50-day moving average (the yellow line) crosses the line that tracks the number of stocks whose 20-day moving average is above their 50-day moving average (the magenta line) there is an expectation that you will get a change in the trend of the S&P 500.

First, note that I had to expand the scale on the right to accommodate the drop in the price of SPY - not a good sign. The number of stocks whose 20-day MA is above their 50-day MA has dropped precipitously. Proving that the market is anything but logical, the number of stocks above their 20-day MA dropped well below one thousand while, as the chart shows, the number of stocks above their 50-day MA actually increased very slightly for the second week in a row. This implies that stocks will have a lot of work to do to get this chart looking bullish again.

This next chart is based on Aroon Analysis and compares our trending statistics to the performance of SPY. We use Aroon to measure whether stocks are in strong up-trends or down-trends. The number of stocks in down-trends is indicated by the red line and the number of stocks in up-trends is indicated by the yellow line.

As can be seen, we are reaching extremes on this chart, too. The number of stocks in up-trends is getting perilously close to zero while the number of stocks in down-trends has exceeded all other readings except for the peak registered last October.

Conclusion --

The last few weeks stocks have moved relentlessly downward. Every indicator reflects the exceedingly oversold nature of the current market situation. Our charts show that things can hardly get any worse. Yet the state of the economy offers nothing much to improve investor sentiment.There are only two themes that provide hope for the markets lately. The first is the "stocks are cheap" thesis. The other is government support. We await the benefits of the stimulus package, the TALF, the TARP, the further bailouts of Citi, AIG and BofA and so on. Ben Bernanke stated the Fed will do whatever it can. The bank stress tests are underway. At some point, investors are looking for all this to start turning the economy around. But when?

This coming week, there is a modest roster of economic reports: wholesale inventories, crude oil inventories, retail sales, business inventories, weekly jobless claims and Michigan sentiment.

What is most anticipated is the discussion in Congress this week of the mark-to-market rule. If the government can't save the banks by pumping money in, the hope is that banks will be given the opportunity to ignore the losses on their illiquid securities.

I can't help but think that we are way overdue for a bounce but, as I write this, I see that the Nikkei has now gone negative after an initial run-up. Is there another week of grinding losses coming up?

Comments

Post a Comment