Go figure. Things were less bad this week but the market didn't really respond.

The Fed eased aggressively and signaled it would do whatever it takes to ensure orderly functioning of the financial markets including buying long-dated treasuries. The White House and Treasury got together and bailed out the automakers with three-month bridge loans and Canada chipped in, too. Tech bellwethers Oracle and Research in Motion brought some cheer to the NASDAQ as they announced decent earnings and didn't slash forward guidance and Best Buy met recently lowered expectations.

Economic reports were again bad this week with industrial production down 0.6% and jobless claims continuing at elevated levels over 500,000 though they were down a bit from the previous week. Both manufacturing surveys, the New York Empire State index and the Philadelphia Fed index both came in at numbers signifying contraction but didn't fall as much as expected. Leading indicators were as poor as anticipated. Still, there was a sense that these numbers could have been a lot worse and there was relief when they weren't.

Nevertheless, major averages were not able to mount a significant rally and break solidly above their 50-day moving averages.

This first chart presents the moving average analysis for the entire market and contrasts it with the performance of the S&P 500 SPDR (SPY). When the number of stocks trading above their 50-day moving average (the yellow line) crosses the line that tracks the number of stocks whose 20-day moving average is above their 50-day moving average (the magenta line) there is an expectation that you will get a change in the trend of the S&P 500.

This week the improvement continues. In the chart above we see that SPY actually fell a bit last week. Our moving average indicators, however, moved ahead nicely. This reflects the fact that the Russell 2000 was up more strongly than the S&P 500 and indicates broader strength in the market than may actually be implied by the performance of the narrower averages. Specifically, nearly one third of all stocks we examined are now above their 50-day exponential moving average. This is the highest number we've had since mid-September. In turn, the number of stocks whose 20-day MA is above their 50-day MA is showing a sustained increase. Implication: looking pretty bullish (providing no new shoes drop).

This next chart is based on Aroon Analysis and compares our trending statistics to the performance of SPY. We use Aroon to measure whether stocks are in strong up-trends or down-trends. The number of stocks in down-trends (the red line) fell again this week to under 1000. Considering this number was over 6000 in October, this is a tremendous improvement. The number of stocks in up-trends (the yellow line) saw a very nicet increase to just over 2000 from 800 last week after having bottomed at 346 a month ago. So far, about 30% of stocks we examined can be considered to be in strong up-trends versus only 12% as of last week. Implication: many more stocks are establishing up-trends while the number or stocks in down-trends diminishes - this also looks pretty bullish.

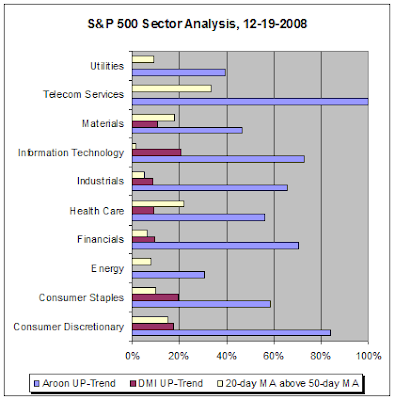

The next chart applies some standard technical indicators to the stocks in the S&P 500 and summarized the result by sector.

Compared to last week, I have had to expand the scale on this chart to the full maximum of 100% from only 35%. This means that the number of stocks in the S&P 500 exhibiting bullish characteristics is growing strongly, at least according to one of our indicators. We are seeing that

Aroon analysis is picking up a greater number of stocks swinging into up-trends. The other indicators we track, DMI up-trend and 20-day MA over 50-day MA are still at very modest levels and improving only slowly.

Major averages are at the top of their Bollinger bands and have so far failed to decisively break above their 50-day moving averages. All our indicators as discussed above are at the best levels we have seen in a month or more. Is there a stimulus that provide that final push to get stocks up to the next level?

We've already had much of the good news that the market was looking for: the automakers got their bailout (billions of dollars from both the U.S. and Canada) and the Fed went all in in terms of rate reduction and a clear cut commitment to quantitative easing. The Obama stimulus plan keeps getting bigger. With Oracle and Research in Motion, we even had a few stocks report decent earnings.

What else is there for investors during this holiday week? The economic calendar has the following: revised numbers on Q3 GDP, existing home sales and new home sales, University of Michigan Consumer Sentiment Index, durable goods orders for November, initial jobless claims, personal income and personal spending for November.

We've only got a few days left for the Santa Claus rally investors have been hoping for and we have already received a couple of big presents from the Fed and the White House. Think we will find a rally under the Christmas tree this week?

The Fed eased aggressively and signaled it would do whatever it takes to ensure orderly functioning of the financial markets including buying long-dated treasuries. The White House and Treasury got together and bailed out the automakers with three-month bridge loans and Canada chipped in, too. Tech bellwethers Oracle and Research in Motion brought some cheer to the NASDAQ as they announced decent earnings and didn't slash forward guidance and Best Buy met recently lowered expectations.

Economic reports were again bad this week with industrial production down 0.6% and jobless claims continuing at elevated levels over 500,000 though they were down a bit from the previous week. Both manufacturing surveys, the New York Empire State index and the Philadelphia Fed index both came in at numbers signifying contraction but didn't fall as much as expected. Leading indicators were as poor as anticipated. Still, there was a sense that these numbers could have been a lot worse and there was relief when they weren't.

Nevertheless, major averages were not able to mount a significant rally and break solidly above their 50-day moving averages.

TradeRadar Alert HQ Stock Market Statistics --

Each week our Alert HQ process scans over 6400 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following charts are based on daily data and present the state of some of our technical indicators.This first chart presents the moving average analysis for the entire market and contrasts it with the performance of the S&P 500 SPDR (SPY). When the number of stocks trading above their 50-day moving average (the yellow line) crosses the line that tracks the number of stocks whose 20-day moving average is above their 50-day moving average (the magenta line) there is an expectation that you will get a change in the trend of the S&P 500.

This week the improvement continues. In the chart above we see that SPY actually fell a bit last week. Our moving average indicators, however, moved ahead nicely. This reflects the fact that the Russell 2000 was up more strongly than the S&P 500 and indicates broader strength in the market than may actually be implied by the performance of the narrower averages. Specifically, nearly one third of all stocks we examined are now above their 50-day exponential moving average. This is the highest number we've had since mid-September. In turn, the number of stocks whose 20-day MA is above their 50-day MA is showing a sustained increase. Implication: looking pretty bullish (providing no new shoes drop).

This next chart is based on Aroon Analysis and compares our trending statistics to the performance of SPY. We use Aroon to measure whether stocks are in strong up-trends or down-trends. The number of stocks in down-trends (the red line) fell again this week to under 1000. Considering this number was over 6000 in October, this is a tremendous improvement. The number of stocks in up-trends (the yellow line) saw a very nicet increase to just over 2000 from 800 last week after having bottomed at 346 a month ago. So far, about 30% of stocks we examined can be considered to be in strong up-trends versus only 12% as of last week. Implication: many more stocks are establishing up-trends while the number or stocks in down-trends diminishes - this also looks pretty bullish.

The next chart applies some standard technical indicators to the stocks in the S&P 500 and summarized the result by sector.

Compared to last week, I have had to expand the scale on this chart to the full maximum of 100% from only 35%. This means that the number of stocks in the S&P 500 exhibiting bullish characteristics is growing strongly, at least according to one of our indicators. We are seeing that

Aroon analysis is picking up a greater number of stocks swinging into up-trends. The other indicators we track, DMI up-trend and 20-day MA over 50-day MA are still at very modest levels and improving only slowly.

Conclusion --

Again this week our stock market statistics based on daily data are reflecting a firming in the market. There has been a definite bullish tone; however, we are at a make or break point now.Major averages are at the top of their Bollinger bands and have so far failed to decisively break above their 50-day moving averages. All our indicators as discussed above are at the best levels we have seen in a month or more. Is there a stimulus that provide that final push to get stocks up to the next level?

We've already had much of the good news that the market was looking for: the automakers got their bailout (billions of dollars from both the U.S. and Canada) and the Fed went all in in terms of rate reduction and a clear cut commitment to quantitative easing. The Obama stimulus plan keeps getting bigger. With Oracle and Research in Motion, we even had a few stocks report decent earnings.

What else is there for investors during this holiday week? The economic calendar has the following: revised numbers on Q3 GDP, existing home sales and new home sales, University of Michigan Consumer Sentiment Index, durable goods orders for November, initial jobless claims, personal income and personal spending for November.

We've only got a few days left for the Santa Claus rally investors have been hoping for and we have already received a couple of big presents from the Fed and the White House. Think we will find a rally under the Christmas tree this week?

Comments

Post a Comment