October came to a close and it was one for the record books. Record volatility, record declines in major averages and record intervention in markets by central banks and governments worldwide.

The final week of the month, however, stood everything on its head. We had bad economic data yet stocks rallied.

Among the awful data points: real GDP declined 0.3% on an annualized basis in the third quarter, impacted by a 3.1% decline in consumer spending. With 70% of economic growth based on consumer spending, that is a worrisome statistic indeed. Consumer confidence hit record lows. Chicago PMI fell by a sizable amount. Jobless claims stayed stubbornly high.

On the positive side of the ledger, credit markets continued to improve with LIBOR extending its decline and the commercial paper market registering increased activity now that the Fed has rolled out a facility to backstop this market, too. New home sales increased a bit, more than analysts expected. The durable goods report featured a higher than expected headline number though down in the details the picture wasn't so rosy for all sectors. Finally, the Fed cut rates to 1%, a reduction of a full 50 bps. Several other central banks in Asia cut rates as well.

Against this backdrop, most of our technical analysis indicators are perking up and beginning to show real signs of better times ahead for investors.

Moving Average Analysis --

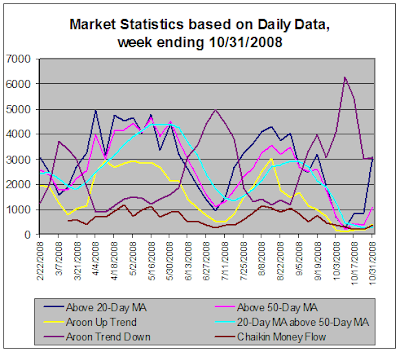

We track the number of stocks that are above various moving averages. The number of stocks above their 20-day moving average jumped by 2000. Meanwhile, the number of stocks above their 50-day moving average moved up quite noticeably and is over 1000 now from just a few hundred a week ago. Though it is hard to see on the chart above, the number of stocks whose 20-day MA is above their 50-day MA finally managed a small increase, the first in nearly two months. These data points strongly imply stocks are rising from the doldrums.

Trend Analysis and Buying Pressure --

As for the trend indicators, we continue to see negativity diminishing. We use Aroon analysis to generate our trending statistics. We again see a small increase in the number of stocks exhibiting strong up-trends though it is from an incredibly low base. It has been encouraging to see the number of stocks exhibiting strong down-trends has decreased dramatically: three weeks ago, it was over 6000 stocks and now it is down to 3000. This past week, unfortunately, the number didn't fall but at least it held steady.

We use Chaikin Money Flow to track buying and selling pressure. Happily we see another slight improvement in buying pressure this week.

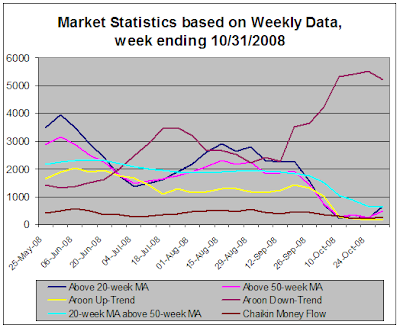

The next chart shows the same indicators based on weekly data rather daily data. With these curves moving more slowly, this week's results show only the modest beginnings of similar improvements in some of the moving average indicators and the Aroon down-trend indicator.

S&P 500 sector analysis --

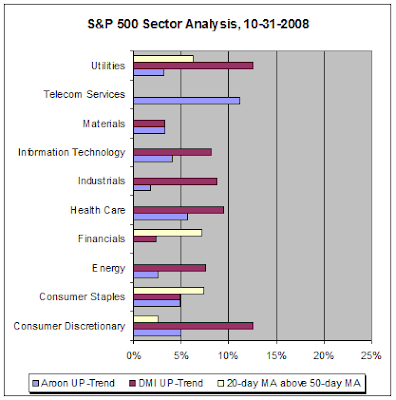

This week we are actually including the chart of S&P 500 sector analysis as there is finally some data to show. Whereas the percentage of stocks exhibiting positive technical characteristics has been near zero for the last few weeks, this time we are seeing the beginnings of real improvement. Though only a few sectors are able to show that more than 10% of their stocks are exhibiting bullish technical characteristics, it is still encouraging to see positive movement and implies some kind of bottom may have been reached.

The change in our indicators also demonstrates how sentiment has changed. Investors are buying stocks even though economic reports are dismal at best. Momentum seems to have turned in the upward direction. Will sentiment continue to support the market? Will the new-found momentum drive the market to further gains?

The coming week will likely provide a test of investor optimism as there is a slew of data to be digested. We will see construction spending, the ISM manufacturing index and services index, auto and truck sales, factory orders, initial jobless claims and the important non-farm payrolls report. It's a safe bet that much of the data will be less than bullish.

And don't forget that there are still plenty of earnings to be reported including General Motors, Cisco Systems, Time Warner and many others. To see a good list, follow this link to Briefing.com's Earnings Calendar.

In any case, it seems that stocks are a buy right now. It's unlikely they will go up in a straight line but it is my feeling that the general direction is indeed "up", at least for a while. Do you think this rally will continue? If so, how far?

Related posts: Yes, Virginia, it's a tradeable rally!

The final week of the month, however, stood everything on its head. We had bad economic data yet stocks rallied.

Among the awful data points: real GDP declined 0.3% on an annualized basis in the third quarter, impacted by a 3.1% decline in consumer spending. With 70% of economic growth based on consumer spending, that is a worrisome statistic indeed. Consumer confidence hit record lows. Chicago PMI fell by a sizable amount. Jobless claims stayed stubbornly high.

On the positive side of the ledger, credit markets continued to improve with LIBOR extending its decline and the commercial paper market registering increased activity now that the Fed has rolled out a facility to backstop this market, too. New home sales increased a bit, more than analysts expected. The durable goods report featured a higher than expected headline number though down in the details the picture wasn't so rosy for all sectors. Finally, the Fed cut rates to 1%, a reduction of a full 50 bps. Several other central banks in Asia cut rates as well.

Against this backdrop, most of our technical analysis indicators are perking up and beginning to show real signs of better times ahead for investors.

TradeRadar Alert HQ Stock Market Statistics --

Each week our Alert HQ process scans over 7200 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following chart based on daily data presents the state of our technical indicators:Moving Average Analysis --

We track the number of stocks that are above various moving averages. The number of stocks above their 20-day moving average jumped by 2000. Meanwhile, the number of stocks above their 50-day moving average moved up quite noticeably and is over 1000 now from just a few hundred a week ago. Though it is hard to see on the chart above, the number of stocks whose 20-day MA is above their 50-day MA finally managed a small increase, the first in nearly two months. These data points strongly imply stocks are rising from the doldrums.

Trend Analysis and Buying Pressure --

As for the trend indicators, we continue to see negativity diminishing. We use Aroon analysis to generate our trending statistics. We again see a small increase in the number of stocks exhibiting strong up-trends though it is from an incredibly low base. It has been encouraging to see the number of stocks exhibiting strong down-trends has decreased dramatically: three weeks ago, it was over 6000 stocks and now it is down to 3000. This past week, unfortunately, the number didn't fall but at least it held steady.

We use Chaikin Money Flow to track buying and selling pressure. Happily we see another slight improvement in buying pressure this week.

The next chart shows the same indicators based on weekly data rather daily data. With these curves moving more slowly, this week's results show only the modest beginnings of similar improvements in some of the moving average indicators and the Aroon down-trend indicator.

S&P 500 sector analysis --

This week we are actually including the chart of S&P 500 sector analysis as there is finally some data to show. Whereas the percentage of stocks exhibiting positive technical characteristics has been near zero for the last few weeks, this time we are seeing the beginnings of real improvement. Though only a few sectors are able to show that more than 10% of their stocks are exhibiting bullish technical characteristics, it is still encouraging to see positive movement and implies some kind of bottom may have been reached.

Conclusion --

Looking at our stock market statistics based on daily data, it looks like stocks are trying to put in some kind of bottom. More than likely it will turn out to be an intermediate bottom and this bounce will end up being a bear market rally. If things play out as the indicators suggest they will, it will be a tradeable rally nonetheless. (For more color on this opinion, read my previous post: "Yes, Virginia, it's a tradeable rally!")The change in our indicators also demonstrates how sentiment has changed. Investors are buying stocks even though economic reports are dismal at best. Momentum seems to have turned in the upward direction. Will sentiment continue to support the market? Will the new-found momentum drive the market to further gains?

The coming week will likely provide a test of investor optimism as there is a slew of data to be digested. We will see construction spending, the ISM manufacturing index and services index, auto and truck sales, factory orders, initial jobless claims and the important non-farm payrolls report. It's a safe bet that much of the data will be less than bullish.

And don't forget that there are still plenty of earnings to be reported including General Motors, Cisco Systems, Time Warner and many others. To see a good list, follow this link to Briefing.com's Earnings Calendar.

In any case, it seems that stocks are a buy right now. It's unlikely they will go up in a straight line but it is my feeling that the general direction is indeed "up", at least for a while. Do you think this rally will continue? If so, how far?

Related posts: Yes, Virginia, it's a tradeable rally!

Comments

Post a Comment