Amidst the gloom and doom, it was a pleasure to read a conference call transcript where the company reported good earnings and committed to a positive forecast. Skyworks Solutions (SWKS) seems to be in a sweet spot and they were happy to share the good news.

First, the company beat expectations on the just finished quarter. Sales rose 22% year over year to $233 million, beating the company’s forecast of $225 million and the average analyst estimate of $226 million. Profit of 21 cents, excluding some costs, beat estimates by a penny. Gross margins expanded to 40.8%.

So much for the past. What about the future?

First, a little background is in order. Skyworks makes semiconductors for the wireless industry. This includes analog and mixed signal integrated circuits used in cell phones, base stations, aerospace-defense, wireless metering and other similar segments. The company has a market cap of about $1 billion. According to Yahoo! Finance it has a price/sales ratio of 1.29 and a PEG ration of only 0.44.

Where most companies are reducing forward guidance Skyworks is maintaining previous estimates. The company acknowledges the economic slowdown but maintains it is in a sweet spot where it will be able maintain growth.

Management points to a number of developments that are positioning the company to prosper while many competitors are finding it tough going. Here the major points as discussed in the company's conference call with analysts:

Skyworks is reaping the benefits of serious investments in engineering and is now able to field the kind of complex chips phone handset vendors are currently demanding. This competitive advantage is not easily overcome.

With many of the contract awards stretching into 2009, management is confident in its prediction that the company will continue to grow.

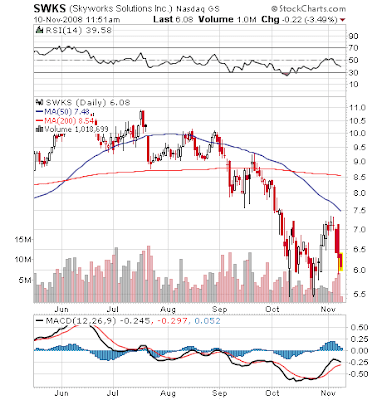

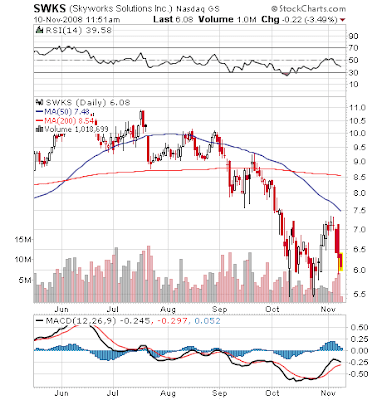

While acknowledging that the economic backdrop is dismal, the company appears to be positioned well to make lemonade from lemons. At only around $6 per share, it is well off its summer '08 peak of $11. With a trailing PE under 13 and a forward PE under 7, Skyworks is certainly worth a look.

Sources: Skyworks Solutions, Inc. FYQ4 2008 Earnings Call Transcript

First, the company beat expectations on the just finished quarter. Sales rose 22% year over year to $233 million, beating the company’s forecast of $225 million and the average analyst estimate of $226 million. Profit of 21 cents, excluding some costs, beat estimates by a penny. Gross margins expanded to 40.8%.

So much for the past. What about the future?

First, a little background is in order. Skyworks makes semiconductors for the wireless industry. This includes analog and mixed signal integrated circuits used in cell phones, base stations, aerospace-defense, wireless metering and other similar segments. The company has a market cap of about $1 billion. According to Yahoo! Finance it has a price/sales ratio of 1.29 and a PEG ration of only 0.44.

Where most companies are reducing forward guidance Skyworks is maintaining previous estimates. The company acknowledges the economic slowdown but maintains it is in a sweet spot where it will be able maintain growth.

Management points to a number of developments that are positioning the company to prosper while many competitors are finding it tough going. Here the major points as discussed in the company's conference call with analysts:

- The company is continuing its diversification strategy by increasing its portfolio of analog components. This has already resulted in contracts with Lockheed Martin, Verizon, Sprint and Nextel. This is expected to continue to yield new opportunities in 2009.

- Skyworks is increasing market share in the fast growing smart phone segment. Skyworks growth rate is twice that of the smart phone market overall.

- They have extended their relationship with Cisco with a suite of new wireless access point solutions.

- They are increasing penetration at all five top tier OEM handset makers, the top two smart phone manufacturers as well as relationships with all base band suppliers

- The weakening industry backdrop is causing vendors to accelerate a move to consolidate on a smaller set of suppliers. Skyworks is maintaining its position as a preferred supplier and the consolidation is allowing the company to increase sales volumes with less competition.

- Another aspect of the weakening industry backdrop is that vendors are increasingly looking for highly integrated, low cost architectures, innovative technology roadmaps, operational scale and balance sheet strength. Management feels they meet all these criteria and contend they are seeing the contract awards to prove it. The company has for years been investing heavily in the engineering required to produce integrated circuits with the complexity required to produce sub-systems on a chip. Now the demand for this type of component is increasing. They are now wielding this capability as a competitive advantage that will take many of their rivals years to match.

- Telecom operators are seeing increasing data traffic via smart phones and other 3G devices. Data is becoming a more important means of monetizing customers for the telcos. Technically, this requires more complex circuitry that provides the ability to seamlessly handle both voice and data while roaming in multiple modes and bands. Once again, Skyworks is already there with the complex chips to handle it.

- Higher complexity chips have higher average selling prices (ASPs) and typically higher margins. The company is increasing demand for these types of chips.

- Skyworks has had a long time focus on continuous improvement and this helps gross margin gains via manufacturing efficiencies, yield improvements and material cost reductions.

- Skyworks gained some new customers by stepping up earlier in the year during a time of supply shortages to provide needed components. These new customers are rewarding Skyworks with new contract awards that will ramp up into 2009.

- The company has applied their technology expertise to expand into new markets such as energy management and wireless meter reading.

Skyworks is reaping the benefits of serious investments in engineering and is now able to field the kind of complex chips phone handset vendors are currently demanding. This competitive advantage is not easily overcome.

With many of the contract awards stretching into 2009, management is confident in its prediction that the company will continue to grow.

While acknowledging that the economic backdrop is dismal, the company appears to be positioned well to make lemonade from lemons. At only around $6 per share, it is well off its summer '08 peak of $11. With a trailing PE under 13 and a forward PE under 7, Skyworks is certainly worth a look.

Sources: Skyworks Solutions, Inc. FYQ4 2008 Earnings Call Transcript

Comments

Post a Comment