Another week for the record books. Congress failed to pass a bailout bill on Monday and the market registered historic losses with the Dow down over 700 points. On Friday, Congress succeeded in passing the bailout bill and guess what? Markets sank anyway. Maybe if the government keeps on passing bailout plans, one of these times we will get a rally.

Well, it really wasn't that surprising to see stocks fall on Friday. With lackluster ISM Services numbers being released a few days after an unexpectedly bad ISM Manufacturing report and then a surprisingly bad Non-farm Payrolls report to cap off the week, there were sufficient reasons of a fundamental nature to cause investors to sell.

If you didn't think those employment numbers were awful and might not have nasty implications for the economy, just look at the following chart (courtesy of the Bureau of Labor Statistics).

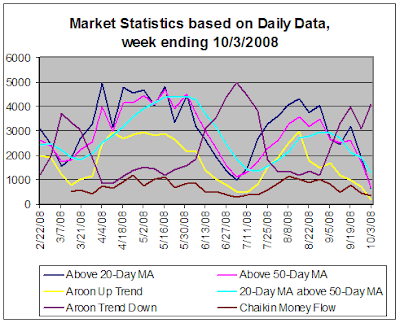

Each week our Alert HQ process scans over 7200 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following chart based on daily data presents the state of our technical indicators:

Each week our Alert HQ process scans over 7200 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following chart based on daily data presents the state of our technical indicators:

We use Chaikin Money Flow to track buying and selling pressure. This week just saw a continuation in the same down-trend in our buying pressure indicator that we have been seeing for weeks. This week, as a matter of fact, has the distinction of registering the lowest level since we started tracking it.

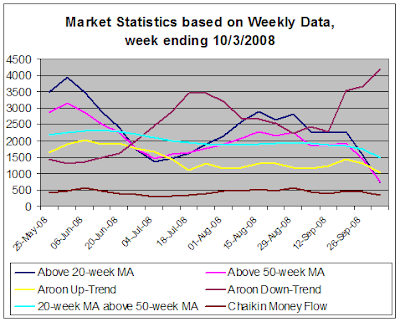

I don't always display the chart that is based on weekly data. The curves are typically slow moving and don't show much. Last week, however, I felt it was worth looking at. This week, again, there is plenty of movement. The Aroon down-trend indicator has hit a record high and the moving average indicators are hitting record lows. Ugly and getting uglier.

Consumer Discretionary is fading while Consumer Staples maintains its strength. Utilities seem to holding onto a certain amount of favor. The Financials are also hanging in there pretty well. This sector should get interesting when the SEC removes the short selling ban.

The remainder of sectors have been decimated.

Our technical review for this week, therefore, is very pessimistic. Everything points down. Investor sentiment seems to have swung negative as even the passage of the bailout bill couldn't generate any buying enthusiasm.

The question now becomes one of degree. So many stocks have fallen into down-trends and so few are managing to show gains that it seems things can't get much worse from here. Unless, of course, we are falling into the kind of brutal bear market we saw after the Internet bubble burst. And that is a chilling thought. According to our work, market internals are now worse than in July and July was worse than in March. Our trend is clear - it is down. Given how much damage stocks have sustained and the danger signals being sent by economic reports, I am more convinced than ever that the eventual long-term rebound will take months to manifest itself.

With stocks in such a dismal state the market is ready for a little bounce. The economic calendar is very light this coming week so investors won't have to be continually reminded that the U.S. seems to be sliding into recession. Two companies are actually fighting over who gets the privilege to acquire a bank! The Citi versus Wells Fargo conflict over buying Wachovia implies that all in the banking sector is not completely doom and gloom. Whether we see a bounce or not this week, however, there is no doubt this bear market has further to go.

Well, it really wasn't that surprising to see stocks fall on Friday. With lackluster ISM Services numbers being released a few days after an unexpectedly bad ISM Manufacturing report and then a surprisingly bad Non-farm Payrolls report to cap off the week, there were sufficient reasons of a fundamental nature to cause investors to sell.

If you didn't think those employment numbers were awful and might not have nasty implications for the economy, just look at the following chart (courtesy of the Bureau of Labor Statistics).

Each week our Alert HQ process scans over 7200 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following chart based on daily data presents the state of our technical indicators:

Each week our Alert HQ process scans over 7200 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following chart based on daily data presents the state of our technical indicators:Moving Average Analysis --

Despite a bounce-back rally on Tuesday, the markets essentially spent the week heading down. The moving average data reflects extreme weakness. The number of stocks above their 20-day moving average and the number of stocks above their 50-day moving average both declined to the lowest levels I have seen since I started tracking this data back in February, 2008. More ominously, the number of stocks whose 20-day moving average is above their 50-day moving average declined again for the fifth week in a row. The rapidity of the decline makes me worry we are still not close to the bottom yet.Trend Analysis and Buying Pressure --

As for the trend indicators, absolutely everything indicates weakness. We use Aroon analysis to generate our trending statistics. This week we saw the number of stocks in strong down-trends increase and the number of stocks exhibiting strong up-trends decrease. Both of these indicators are reaching extreme levels and show how poorly stocks are behaving.We use Chaikin Money Flow to track buying and selling pressure. This week just saw a continuation in the same down-trend in our buying pressure indicator that we have been seeing for weeks. This week, as a matter of fact, has the distinction of registering the lowest level since we started tracking it.

I don't always display the chart that is based on weekly data. The curves are typically slow moving and don't show much. Last week, however, I felt it was worth looking at. This week, again, there is plenty of movement. The Aroon down-trend indicator has hit a record high and the moving average indicators are hitting record lows. Ugly and getting uglier.

S&P 500 Sector Analysis

Here is our analysis of the performance of the various sectors that make up the S&P 500. This is the weakest I have seen it since I started doing this kind of analysis.Consumer Discretionary is fading while Consumer Staples maintains its strength. Utilities seem to holding onto a certain amount of favor. The Financials are also hanging in there pretty well. This sector should get interesting when the SEC removes the short selling ban.

The remainder of sectors have been decimated.

Conclusion --

I keep referring to how ominous it is that the number of stocks whose 20-day moving average is above their 50-day moving average continues to decline. There is an excellent post over at Minyanville which discusses the significance of a similar indicator (read it here). They discuss the importance of watching the 50-day moving average in relation to the 200-day moving average. Though they use longer time intervals than we do at Trade-Radar, the concepts are the same.Our technical review for this week, therefore, is very pessimistic. Everything points down. Investor sentiment seems to have swung negative as even the passage of the bailout bill couldn't generate any buying enthusiasm.

The question now becomes one of degree. So many stocks have fallen into down-trends and so few are managing to show gains that it seems things can't get much worse from here. Unless, of course, we are falling into the kind of brutal bear market we saw after the Internet bubble burst. And that is a chilling thought. According to our work, market internals are now worse than in July and July was worse than in March. Our trend is clear - it is down. Given how much damage stocks have sustained and the danger signals being sent by economic reports, I am more convinced than ever that the eventual long-term rebound will take months to manifest itself.

With stocks in such a dismal state the market is ready for a little bounce. The economic calendar is very light this coming week so investors won't have to be continually reminded that the U.S. seems to be sliding into recession. Two companies are actually fighting over who gets the privilege to acquire a bank! The Citi versus Wells Fargo conflict over buying Wachovia implies that all in the banking sector is not completely doom and gloom. Whether we see a bounce or not this week, however, there is no doubt this bear market has further to go.

Comments

Post a Comment