Questions of the day: Is the cup half full or half empty? Have we hit the bottom or is there more pain in store? Should we buy or sell?

This past week saw continued improvements in the credit market with Libor declining and slight glimmers of activity in commercial paper now that the Fed is backstopping that market, too.

Commodity prices fell again. For those who are inclined to the optimistic side, this is good news for consumers. For those inclined to be pessimistic, this is a further signal of demand destruction and another indicator of how long and deep the recession will be.

Earnings season proceeds apace. Optimists point to the greater than expected number of companies that are beating analyst expectations. Pessimists point to the almost uniform negativity of forward guidance provided by nearly every company and the increasingly common announcements of job cuts.

Further evidence that decoupling is a myth was provided when the UK reported a 0.5% decline in their third quarter GDP, foreign markets tumbled and the US markets followed suit.

Apparently, those who think the glass is half empty prevailed this week as the Dow fell 5.3%, the S&P 500 fell 6.8%, the Nasdaq plunged 9.3% and the Russell 2000 fell double digits, tumbling 10.5%.

Despite a number of former bears announcing that they think stocks are now cheap enough to buy at current levels, most investors seemed more inclined to sell.

Against this backdrop, most technical analysis indicators are predictably bearish. Among the ones we track, only a few show any signs of better times ahead.

Moving Average Analysis --

We track the number of stocks that are above various moving averages. The number of stocks above their 20-day moving average actually increased for the second week in a row. Meanwhile, the number of stocks above their 50-day moving average declined. The number of stocks whose 20-day MA is above their 50-day MA continues to decline though for the last two weeks now it has been declining much more slowly.

Trend Analysis and Buying Pressure --

As for the trend indicators, we see the negativity diminishing. We use Aroon analysis to generate our trending statistics. We actually see a small increase in the number of stocks exhibiting strong up-trends though the short and ultra short ETFs are making up a good portion of the number. More encouraging is the fact that we see the number of stocks exhibiting strong down-trends has decreased dramatically, going from 5447 to 2989.

We use Chaikin Money Flow to track buying and selling pressure. Happily we see a slight improvement in buying pressure this week despite the big drops in the major averages.

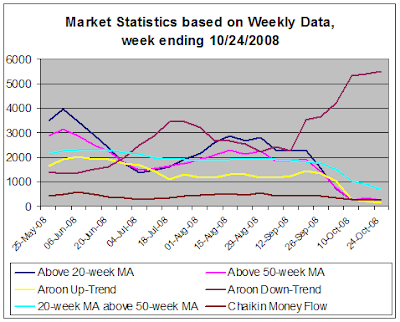

The next chart shows the same indicators based on weekly data rather daily data. With these curves moving more slowly, this week's results provide absolutely no improvement in outlook. Each one of the indicators shows further deterioration though that deterioration is not accelerating.

We often show a weekly chart that provides an analysis of each sector in the S&P 500. This week we again don't bother to show the chart. There is only one stock exhibiting an Aroon up-trend, one stock exhibiting an up-trend according to DMI analysis and only nine stocks whose 20-day MA is above their 50-day MA. Essentially, the chart would be nearly blank as the 500 stocks in the index are nearly all devastated and we are registering the worst numbers since we started keeping track.

On the other hand, looking at the stock market statistics based on weekly data, the trend still appears, without question, to be down.

Investors are now taking improvement in credit markets and last quarter's earnings for granted and are focusing instead on earnings guidance and expectations for how deep a recession we may have to endure.

It is said that the stock market is a forward looking indicator. Thus far, it seems the market is looking forward to rough economic times.

What might we see to change the minds of investors?

This week we will receive plenty more earnings reports from the likes of Verizon, SAP, U.S. Steel, Valero Energy, Legg Mason, Moody's, Newmont Mining, ValueClick, Exxon Mobil, CBS and many more.

We also have a heavy schedule of economic reports coming up this week: new home sales, consumer confidence, durable goods orders, crude inventories, advance GDP for the last quarter, initial jobless claims, personal income & spending, Chicago Purchasing Managers Index and the Michigan consumer sentiment survey. In addition, the statement from the last FOMC meeting will be published.

Plenty for investors to chew on. Prepare for the stock market to bounce up and down like a yo-yo. No matter whether you think the glass is half empty or half full, I wouldn't be surprised to see the glass tip over this week.

This past week saw continued improvements in the credit market with Libor declining and slight glimmers of activity in commercial paper now that the Fed is backstopping that market, too.

Commodity prices fell again. For those who are inclined to the optimistic side, this is good news for consumers. For those inclined to be pessimistic, this is a further signal of demand destruction and another indicator of how long and deep the recession will be.

Earnings season proceeds apace. Optimists point to the greater than expected number of companies that are beating analyst expectations. Pessimists point to the almost uniform negativity of forward guidance provided by nearly every company and the increasingly common announcements of job cuts.

Further evidence that decoupling is a myth was provided when the UK reported a 0.5% decline in their third quarter GDP, foreign markets tumbled and the US markets followed suit.

Apparently, those who think the glass is half empty prevailed this week as the Dow fell 5.3%, the S&P 500 fell 6.8%, the Nasdaq plunged 9.3% and the Russell 2000 fell double digits, tumbling 10.5%.

Despite a number of former bears announcing that they think stocks are now cheap enough to buy at current levels, most investors seemed more inclined to sell.

Against this backdrop, most technical analysis indicators are predictably bearish. Among the ones we track, only a few show any signs of better times ahead.

TradeRadar Alert HQ Stock Market Statistics --

Each week our Alert HQ process scans over 7200 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following chart based on daily data presents the state of our technical indicators:Moving Average Analysis --

We track the number of stocks that are above various moving averages. The number of stocks above their 20-day moving average actually increased for the second week in a row. Meanwhile, the number of stocks above their 50-day moving average declined. The number of stocks whose 20-day MA is above their 50-day MA continues to decline though for the last two weeks now it has been declining much more slowly.

Trend Analysis and Buying Pressure --

As for the trend indicators, we see the negativity diminishing. We use Aroon analysis to generate our trending statistics. We actually see a small increase in the number of stocks exhibiting strong up-trends though the short and ultra short ETFs are making up a good portion of the number. More encouraging is the fact that we see the number of stocks exhibiting strong down-trends has decreased dramatically, going from 5447 to 2989.

We use Chaikin Money Flow to track buying and selling pressure. Happily we see a slight improvement in buying pressure this week despite the big drops in the major averages.

The next chart shows the same indicators based on weekly data rather daily data. With these curves moving more slowly, this week's results provide absolutely no improvement in outlook. Each one of the indicators shows further deterioration though that deterioration is not accelerating.

We often show a weekly chart that provides an analysis of each sector in the S&P 500. This week we again don't bother to show the chart. There is only one stock exhibiting an Aroon up-trend, one stock exhibiting an up-trend according to DMI analysis and only nine stocks whose 20-day MA is above their 50-day MA. Essentially, the chart would be nearly blank as the 500 stocks in the index are nearly all devastated and we are registering the worst numbers since we started keeping track.

Conclusion --

Looking at our stock market statistics based on daily data, it looks like stocks are trying to put in some kind of bottom. The fact that we more or less held the previous lows and that a few more stocks are above their 20-day moving average is hopeful. It appears that, in aggregate, the fall in stock prices is at least slowing.On the other hand, looking at the stock market statistics based on weekly data, the trend still appears, without question, to be down.

Investors are now taking improvement in credit markets and last quarter's earnings for granted and are focusing instead on earnings guidance and expectations for how deep a recession we may have to endure.

It is said that the stock market is a forward looking indicator. Thus far, it seems the market is looking forward to rough economic times.

What might we see to change the minds of investors?

This week we will receive plenty more earnings reports from the likes of Verizon, SAP, U.S. Steel, Valero Energy, Legg Mason, Moody's, Newmont Mining, ValueClick, Exxon Mobil, CBS and many more.

We also have a heavy schedule of economic reports coming up this week: new home sales, consumer confidence, durable goods orders, crude inventories, advance GDP for the last quarter, initial jobless claims, personal income & spending, Chicago Purchasing Managers Index and the Michigan consumer sentiment survey. In addition, the statement from the last FOMC meeting will be published.

Plenty for investors to chew on. Prepare for the stock market to bounce up and down like a yo-yo. No matter whether you think the glass is half empty or half full, I wouldn't be surprised to see the glass tip over this week.

Comments

Post a Comment