A stunning week and thank goodness it's over! Records were set on the downside with major averages sliding 18% over the course of five tumultuous sessions. Over the course of the last two weeks, we essentially met the definition of "crash" - a more than 20% drop in a short period of time. Selling was relentless all week long with only the NASDAQ Composite managing to close in positive territory by a few points on Friday.

As an indication of how pessimistic investors were this week, you have to realize that this selling took place despite the unprecedented coordinated global rate cut, decent earnings and forward guidance from bellwethers IBM and GE and commitments by the U.S. government to backstop commercial paper.

The short selling ban expired at midnight on Wednesday yet financial stocks rallied on Friday. Go figure.

All in all, it was a good week to be short or in cash. Investors focused not only on the continuing problems in the credit markets but also on accelerating problems in the economy. Jobless claims continued to signal tough times for workers, retailers reported very bad numbers indicating consumers are hunkering down. The plunge in commodities including oil, corn and soybeans signaled the possibilities of a global contraction. In Europe and Iceland, governments took steps to guarantee bank deposits or took over banks outright. It was a downright scary week.

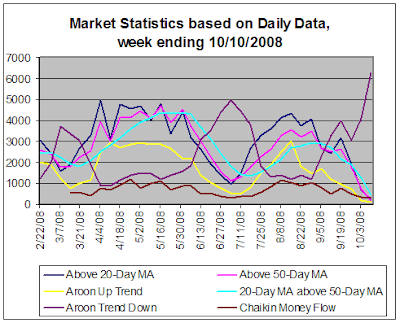

Wow, the data looks like it is trying to fall off the chart.

Moving Average Analysis --

Out of 7200 stocks that we track, can you believe that only a couple of hundred are above their 20-day moving average or above their 50-day moving average? I keep an especially close eye on the number of stocks whose 20-day MA is above their 50-day MA. It is hard to believe that this number has fallen to less than 500. That is only 7% of all stocks we track. Unbelievable!

Trend Analysis and Buying Pressure --

As for the trend indicators, again this week absolutely everything indicates weakness. We use Aroon analysis to generate our trending statistics. This week we saw the number of stocks in strong down-trends increase to over 6000 out of 7200. That's 83% of all stocks we track! The number of stocks exhibiting strong up-trends has decreased to under 300 or only 4% of all stocks.. It goes without saying that both of these indicators are reaching extreme levels.

We use Chaikin Money Flow to track buying and selling pressure. This week just saw a continuation in the same down-trend in our buying pressure indicator that we have been seeing for weeks. Again tis week, we can say that it has the distinction of registering the lowest level since we started tracking it at a level under 300.

We won't include the chart based on weekly data as it just displays more of the same.

The surprise of the group, though, is the Financial sector which is showing surprising strength based on Friday's rally in the sector.

With our stock market statistics looking as bad as they do right now, though, it would seem a snap-back rally would be all but certain. Indeed, on Friday we saw a furious rally that took the major averages from a 7% deficit up to a closing loss of only 1%. The Financial sector even managed to finish at the highs of the day in solidly positive territory (more on that in another post soon).

But how much can the market rally? The credit system is still a shambles. The G7 can't agree on coordinated action. Earnings season is starting and the outlook from most analysts is that it's going be dismal.

To further roil markets, we have a big roster of economic reports coming up this week. We will see PPI and CPI, the New York Empire State index, retail sales, crude inventories, the Fed Beige Book, initial jobless claims, industrial production, the Philadelphia Fed regional manufacturing survey, building permits and housing starts and the Michigan Sentiment index. The outlook for most of these reports is not particularly rosy. Any positive surprise could indeed get that snap-back rally going but any significant surprise to the downside could see the beatings resume.

Here, though, is where we separate the traders from the investors. Jumping on this snap-back rally, should it occur, may require exquisite timing in order to protect profits when the rally runs out of gas. To me, that's trading, not investing. And even traders need a certain amount of luck to avoid getting burned in markets like these. So tell me, are you feeling lucky?

As an indication of how pessimistic investors were this week, you have to realize that this selling took place despite the unprecedented coordinated global rate cut, decent earnings and forward guidance from bellwethers IBM and GE and commitments by the U.S. government to backstop commercial paper.

The short selling ban expired at midnight on Wednesday yet financial stocks rallied on Friday. Go figure.

All in all, it was a good week to be short or in cash. Investors focused not only on the continuing problems in the credit markets but also on accelerating problems in the economy. Jobless claims continued to signal tough times for workers, retailers reported very bad numbers indicating consumers are hunkering down. The plunge in commodities including oil, corn and soybeans signaled the possibilities of a global contraction. In Europe and Iceland, governments took steps to guarantee bank deposits or took over banks outright. It was a downright scary week.

TradeRadar Alert HQ Stock Market Statistics --

Each week our Alert HQ process scans over 7200 stocks and ETFs and records their technical characteristics. Primarily we look for BUY and SELL signals for our free stock alerts; however, we also summarize the data in order to gain insights in the week's market action. The following chart based on daily data presents the state of our technical indicators:Wow, the data looks like it is trying to fall off the chart.

Moving Average Analysis --

Out of 7200 stocks that we track, can you believe that only a couple of hundred are above their 20-day moving average or above their 50-day moving average? I keep an especially close eye on the number of stocks whose 20-day MA is above their 50-day MA. It is hard to believe that this number has fallen to less than 500. That is only 7% of all stocks we track. Unbelievable!

Trend Analysis and Buying Pressure --

As for the trend indicators, again this week absolutely everything indicates weakness. We use Aroon analysis to generate our trending statistics. This week we saw the number of stocks in strong down-trends increase to over 6000 out of 7200. That's 83% of all stocks we track! The number of stocks exhibiting strong up-trends has decreased to under 300 or only 4% of all stocks.. It goes without saying that both of these indicators are reaching extreme levels.

We use Chaikin Money Flow to track buying and selling pressure. This week just saw a continuation in the same down-trend in our buying pressure indicator that we have been seeing for weeks. Again tis week, we can say that it has the distinction of registering the lowest level since we started tracking it at a level under 300.

We won't include the chart based on weekly data as it just displays more of the same.

S&P 500 Sector Analysis --

I include the chart below only for shock value. We track the stocks that make up the various sectors of the S&P 500 using some of the same indicators discussed above. I am stunned to see the chart is almost bare. The Financial sector is the only one with any number of stocks registering an up-trend according to DMI analysis. None of the stocks in any sector is registering an up-trend based on Aroon analysis. Even the stalwart Consumer Staples sector is flagging with less than 20% of the stocks in the sector maintaining their 20-day MA above their 50-day MA.The surprise of the group, though, is the Financial sector which is showing surprising strength based on Friday's rally in the sector.

Conclusion --

Boy, stocks got beaten down again this week, beaten with a stick, as they say.With our stock market statistics looking as bad as they do right now, though, it would seem a snap-back rally would be all but certain. Indeed, on Friday we saw a furious rally that took the major averages from a 7% deficit up to a closing loss of only 1%. The Financial sector even managed to finish at the highs of the day in solidly positive territory (more on that in another post soon).

But how much can the market rally? The credit system is still a shambles. The G7 can't agree on coordinated action. Earnings season is starting and the outlook from most analysts is that it's going be dismal.

To further roil markets, we have a big roster of economic reports coming up this week. We will see PPI and CPI, the New York Empire State index, retail sales, crude inventories, the Fed Beige Book, initial jobless claims, industrial production, the Philadelphia Fed regional manufacturing survey, building permits and housing starts and the Michigan Sentiment index. The outlook for most of these reports is not particularly rosy. Any positive surprise could indeed get that snap-back rally going but any significant surprise to the downside could see the beatings resume.

Here, though, is where we separate the traders from the investors. Jumping on this snap-back rally, should it occur, may require exquisite timing in order to protect profits when the rally runs out of gas. To me, that's trading, not investing. And even traders need a certain amount of luck to avoid getting burned in markets like these. So tell me, are you feeling lucky?

Comments

Post a Comment