Today I did a comparison of value versus growth funds using the ProShares family of ETFs. ProShares provides a selection of Ultra-long ETFs as follows:

They also provide a selection of Ultra Short ETFs as follows:

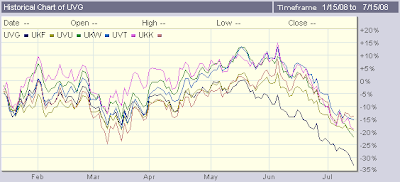

Looking at the relative performance of the Ultra Long ETFs, it is clear that large cap value is underperforming by a wide margin. The following chart shows how UVG, the Ultra Russell 1000 Value ETF, is doing significantly worse than the other ETFs.

In looking at the constituent holdings of the Ultra Russell 1000 Value (UVG) ETF, we see that the ETF contains lots of financial stocks, 165 of them to be exact. Many of these stocks are the same names that have been written about in the financial media due to write-offs, recapitalizations, sagging balance sheets, quarterly losses and every other kind of shoe dropping bad news that has befallen the financial sector.

Also included are a large number of REITs. Of the 165 financial stocks in the underlying index for the UVG ETF, 37 are REITs.

Value investors seek not just make a profit but to have as large a margin of safety as possible. After a prolonged market downturn, it is reasonable for value investors to look at certain beaten down stocks as ripe for a rebound. The other part of the value analysis is to determine if the stock in question actually has the potential for earnings growth to justify a future higher price and, given the current price and financial situation, whether the likelihood of a near term price decline is small. Many value investors also feel that the more obscure a stock is, the more of an edge the value investor has over the general market.

In the case of the Russell 1000 Value index and ETF, the stocks are all well-known large-caps. This violates the last principle mentioned in the previous paragraph. More seriously, many of the constituent stocks, though certainly low priced on a price to book basis, for example, have very uncertain futures. In particular, I'm talking about the financial stocks

In conclusion, the Russell 1000 Value ETF (UVG) is clearly over-sold; however, an investor buying this ETF has to be comfortable with owning a large proportion of financials, many of whom may see depressed earnings for many more quarters to come, are facing increased regulation and are seeing certain lucrative lines of business like mortgage backed securities and leveraged buyouts disappear.

Value investing as a methodology remains valid but investors need to know what they are getting into when buying the Russell 1000 Value ETF.

Disclosure: none

Ultra Russell 1000 Value (UVG)

Ultra Russell 1000 Growth (UKF)

Ultra Russell MidCap Value (UVU)

Ultra Russell MidCap Growth (UKW)

Ultra Russell 2000 Value (UVT)

Ultra Russell 2000 Growth (UKK)

Ultra Russell 1000 Growth (UKF)

Ultra Russell MidCap Value (UVU)

Ultra Russell MidCap Growth (UKW)

Ultra Russell 2000 Value (UVT)

Ultra Russell 2000 Growth (UKK)

They also provide a selection of Ultra Short ETFs as follows:

UltraShort Russell 1000 Value (SJF)

UltraShort Russell 1000 Growth (SFK)

UltraShort Russell MidCap Value (SJL)

UltraShort Russell MidCap Growth (SDK)

UltraShort Russell 2000 Value (SJH)

UltraShort Russell 2000 Growth (SKK)

UltraShort Russell 1000 Growth (SFK)

UltraShort Russell MidCap Value (SJL)

UltraShort Russell MidCap Growth (SDK)

UltraShort Russell 2000 Value (SJH)

UltraShort Russell 2000 Growth (SKK)

Looking at the relative performance of the Ultra Long ETFs, it is clear that large cap value is underperforming by a wide margin. The following chart shows how UVG, the Ultra Russell 1000 Value ETF, is doing significantly worse than the other ETFs.

In looking at the constituent holdings of the Ultra Russell 1000 Value (UVG) ETF, we see that the ETF contains lots of financial stocks, 165 of them to be exact. Many of these stocks are the same names that have been written about in the financial media due to write-offs, recapitalizations, sagging balance sheets, quarterly losses and every other kind of shoe dropping bad news that has befallen the financial sector.

Also included are a large number of REITs. Of the 165 financial stocks in the underlying index for the UVG ETF, 37 are REITs.

Value investors seek not just make a profit but to have as large a margin of safety as possible. After a prolonged market downturn, it is reasonable for value investors to look at certain beaten down stocks as ripe for a rebound. The other part of the value analysis is to determine if the stock in question actually has the potential for earnings growth to justify a future higher price and, given the current price and financial situation, whether the likelihood of a near term price decline is small. Many value investors also feel that the more obscure a stock is, the more of an edge the value investor has over the general market.

In the case of the Russell 1000 Value index and ETF, the stocks are all well-known large-caps. This violates the last principle mentioned in the previous paragraph. More seriously, many of the constituent stocks, though certainly low priced on a price to book basis, for example, have very uncertain futures. In particular, I'm talking about the financial stocks

In conclusion, the Russell 1000 Value ETF (UVG) is clearly over-sold; however, an investor buying this ETF has to be comfortable with owning a large proportion of financials, many of whom may see depressed earnings for many more quarters to come, are facing increased regulation and are seeing certain lucrative lines of business like mortgage backed securities and leveraged buyouts disappear.

Value investing as a methodology remains valid but investors need to know what they are getting into when buying the Russell 1000 Value ETF.

Disclosure: none

Comments

Post a Comment